[Macro on Microchips] Chipmakers Lose Momentum Amid Policy Noise and Strategic Drift

Chipmakers adapt to shifting geopolitics as Samsung stalls in Texas, U.S. eases China curbs, and TSMC accelerates U.S. buildout under tariff pressure.

After a strong finish in June, semiconductor stocks cooled last week, with the SOXX ETF slipping 0.58% and underperforming the S&P 500. Investor positioning turned defensive as tariff uncertainty resurfaced and sector catalysts thinned out.

In this edition, we look beyond the short-term chop to unpack three key developments: Samsung’s faltering U.S. foundry ambitions, a temporary thaw in U.S.-China chip software restrictions, and how TSMC is tactically repositioning amid intensifying tariff pressure. Each offers a window into how supply chains and capital allocation are shifting under the weight of both geopolitics and execution risk.

Stock Scoreboard

After a strong performance the week before, semiconductor stocks declined 0.58% over five sessions, underperforming the S&P 500 by nearly 1%.

Market breadth turned more cautious, with half of the ten SOXX heavyweights in the red, most notably AMD and Marvell, which gave back recent AI-driven gains and led the pack the week before.

Despite Texas Instruments and KLA Corporation posting modest gains, the sector lacked a fresh catalyst.

Volatility readings picked up across the board, and investor positioning leaned defensive, as seen in the uptick in implied volatility percentiles for key names.

Having said that, sector-wide sentiment surged mid-week when lawmakers approved an increase in the U.S. investment tax credit for domestic chip production to 35%, spurring optimism for capex-heavy names as well as equipment suppliers.

Monday’s dip was attributed yet again to uncertainties regarding how and when the tariffs would be implemented, and whether semis would be included, especially in the ones announced already for Japan and South Korea.

KEY HEADLINES:

Samsung’s Texas Gamble Pauses as AI Demand Bypasses Its Foundry

Samsung Electronics has hit the brakes on its $37 billion Texas chipmaking push, with sources confirming delays at its Taylor fab due to an absence of customer orders and shifting tech demands. Originally slated to go online in 2024, the plant’s launch has now been pushed to 2026, with no clarity on when chipmaking equipment will even be installed.

Despite construction being 92% complete, insiders suggest Samsung is caught between process node mismatches, a tepid U.S. client pipeline, and a global oversupply of non-AI chips.

The fab is backed by up to $4.7 billion in CHIPS Act subsidies and was meant to be Samsung’s cutting-edge U.S. showcase. But the foundry roadmap hasn’t kept pace. Plans to manufacture 4nm chips have shifted to 2nm ambitions, but meaningful progress remains elusive.

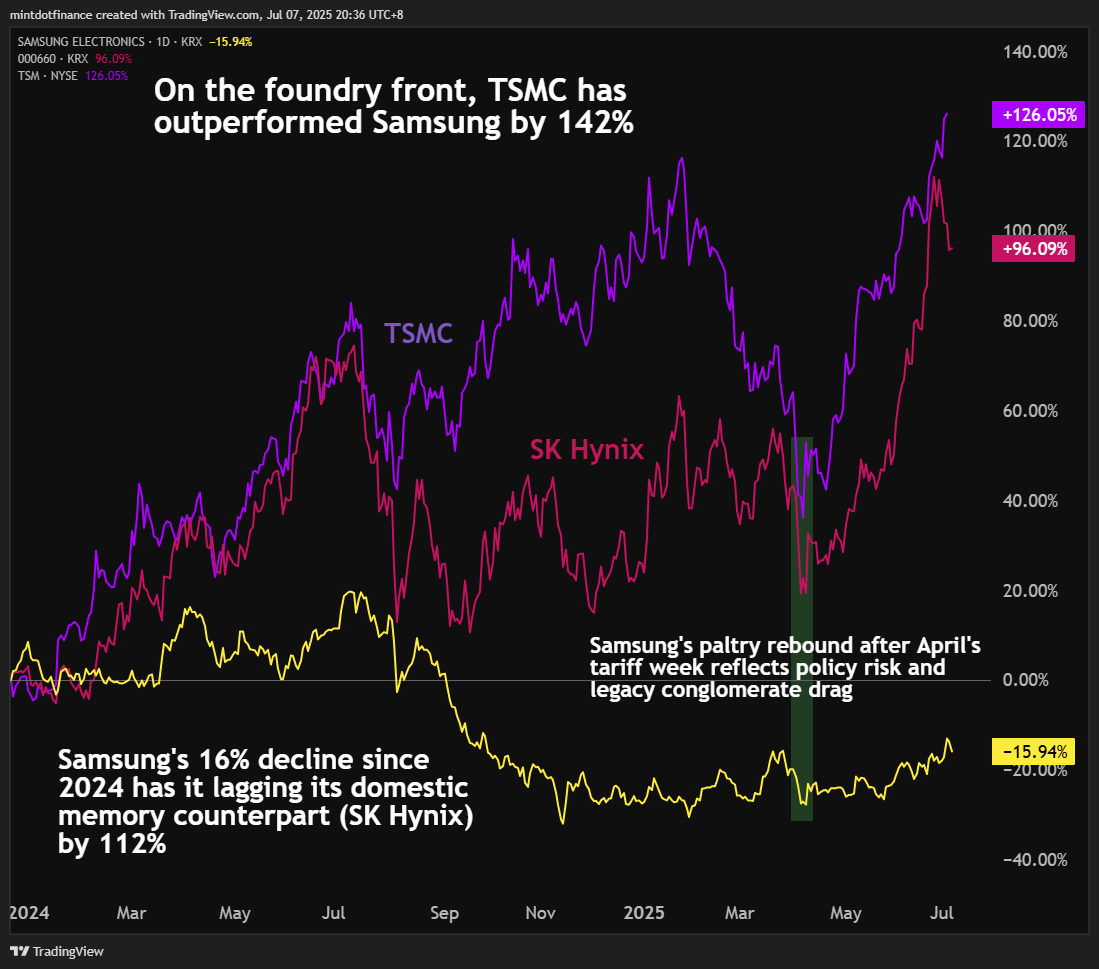

Samsung’s U.S. struggles also reflect deeper issues within its foundry business. With just 7.7% of global contract chipmaking share (vs. TSMC’s 67.6%), Samsung continues to lag in yield performance and capacity utilisation. The fallout from U.S. restrictions on advanced chip exports to China has also hurt momentum, even as Samsung works to secure new sub-5nm clients.

That strain is also bleeding into its financials. Today, Samsung projected up to 56% drop in Q2 operating profit, blaming U.S. curbs on China. Analysts, though, cite sluggish progress in supplying high-bandwidth memory (HBM) chips to Nvidia, despite early hopes of HBM3E shipments this year. While Samsung has begun some HBM supply to AMD, its U.S. positioning remains fragile.

While TSMC consolidates AI client wins and Micron rides HBM demand tailwinds, Samsung risks being left behind in the U.S. chip supply chain reshuffle. Without a clearer roadmap for customer acquisition and AI node readiness, Taylor may remain a half-built monument to mistimed ambition.

Chip Software Curbs Lifted as Rare Earth Deal Kicks In

The Biden–Trump administration’s post-London trade truce with China is beginning to show material outcomes. Last week, the U.S. rescinded export restrictions on chip design software—critical Electronic Design Automation (EDA) tools—from Synopsys, Cadence, and Siemens, effectively reversing a May decision that cut off Chinese access to next-gen chip development infrastructure.

All three companies have confirmed the rollback, with Siemens resuming full support for Chinese clients and the others assessing commercial impact.

The move is part of a broader deal struck in London last month, in which the U.S. agreed to lift controls on chip software, ethane, and jet engine exports, while China would restart rare earth shipments under its existing licensing regime.

For China’s chip ecosystem, the unblocking of EDA access is a reprieve. The three firms account for 70% of China’s design software market, and the ban’s continuation would have halted progress in sub-7nm development. For the U.S., it’s a signal of détente but not detachment. Tariffs remain high (55% according to Trump), and the truce expires in August.

This easing of EDA restrictions won’t reverse Washington’s strategic posture, but it does mark a pause in escalation amid broader policy recalibration. With CHIPS Act disbursements underway, and export controls still in place for hardware like Nvidia’s H20, the U.S. continues to walk a fine line: protect its tech edge, but avoid total supply chain fracture.

TSMC Nudges Japan Fab as U.S. Pressure Builds Ahead of Tariff Clock

TSMC is reportedly slowing work on its second chip plant in Japan as it accelerates investments in the U.S., anticipating potential Section 232 tariffs under the Trump administration. The company denies any formal reprioritization, but sources confirm that construction of the Kumamoto facility has slipped amid infrastructure delays and internal budget reallocation toward its Arizona buildout.

Trump’s investigation under Section 232 could potentially target Taiwan-made chips as a national security threat. That’s critical for TSMC, which supplies nearly all of Nvidia’s AI chips and manufactures processors for Apple, Qualcomm, and AMD.

In the U.S., TSMC is fast-tracking its Fab 21 Phase 2 timeline to deliver 3nm production in 2027, and is preparing to build out two additional fabs targeting its 2nm and A16 nodes.

Meanwhile, its official stance is that projects in Japan and Germany remain unaffected. But with its $42 billion capex already stretched and multiple nations vying for domestic fabs, the balancing act is getting harder.

Behind the scenes, Taiwanese lawmakers have passed new rules requiring TSMC’s most advanced nodes to remain onshore, meaning even its U.S. 2nm rollout will lag Taiwan by several years. That delay could further complicate Washington’s desire for on-soil tech sovereignty, especially if tariffs are triggered before Arizona output ramps.

TSMC insists its global plans are intact, but the signal is clear: in a tariff-heavy environment, it is the U.S. that gets built out first—and Taiwan that keeps the tech edge.

SOXX ETF

The SOXX lost 0.58% last week, with net outflows of $277 million over five sessions as against the $4 million in the week before. AUM is now at $13.6 billion, the highest since late February.

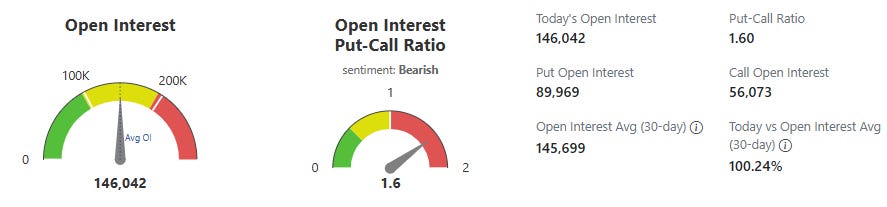

The open interest for SOXX options at 146,042 contracts is at par with the 30-day average, but is also 8% higher than last week’s OI. The week-on-week increase in market activity has consolidated the bearish PCR outlook, which currently stands at 1.6 as against 1.48 from the week before.

Friday’s close last week above $243 signalled continued underlying momentum, even as price action has stayed rangebound over the week and especially relative to June highs. The MACD remains in a positive crossover, and RSI is holding comfortably above neutral, suggesting the broader setup still favours upside, albeit much steadier than impulsive.

Yet the hesitation in open interest and the persistently high put-call ratio tell a different story. The PCR's rise to 1.6 despite the bounce hints at hedged long exposure, and the divergence between healthy (albeit waning) technicals and defensive positioning betrays the late-cycle behaviour within a rally, where participants want in, but not without insurance.

One possibility is that the ETF is being propped up by flows into passive large-cap tech allocations, while active participants remain wary of macro crosscurrents, chiefly tariffs.

Takeaway

The semiconductor sector’s momentum is now splintering along lines of execution capability and strategic clarity rather than simply macro policy shifts. Samsung’s stalled Texas fab underscores that having deep pockets and government backing isn’t enough without clear customer commitments and technical alignment.

Meanwhile, TSMC’s careful shift of investment from Japan toward U.S. shores underlines how nimble companies respond proactively to evolving trade winds and policy uncertainty.

Still, the sector’s top-line clarity with regard to surging AI demand and generous government incentives was overshadowed yet again by the opaque timeline and extent of tariff implementations, driving stocks into a state of persistent indecision.

Investors aren’t simply wary of tariff headwinds but are also uncertain of their ultimate form and timing, keeping incremental risk appetite in check. With implied volatility edging higher and defensive positioning intensifying, smart money will differentiate clearly between well-positioned, strategically agile players and those still caught in indecision.

IVs on tariff-sensitive names remain attractively priced for protective strategies, and near-term weakness may be opportunities to selectively build positions in companies better insulated against geopolitical noise, particularly U.S.-focused semiconductor equipment makers and firms with unambiguous exposure to AI infrastructure demand.