[Macro on Microchips] Semiconductors Rise, But Investors Still Prefer Clarity Over Momentum

Fund flows return, but positioning stays hedged as investors rotate into equipment and memory names.

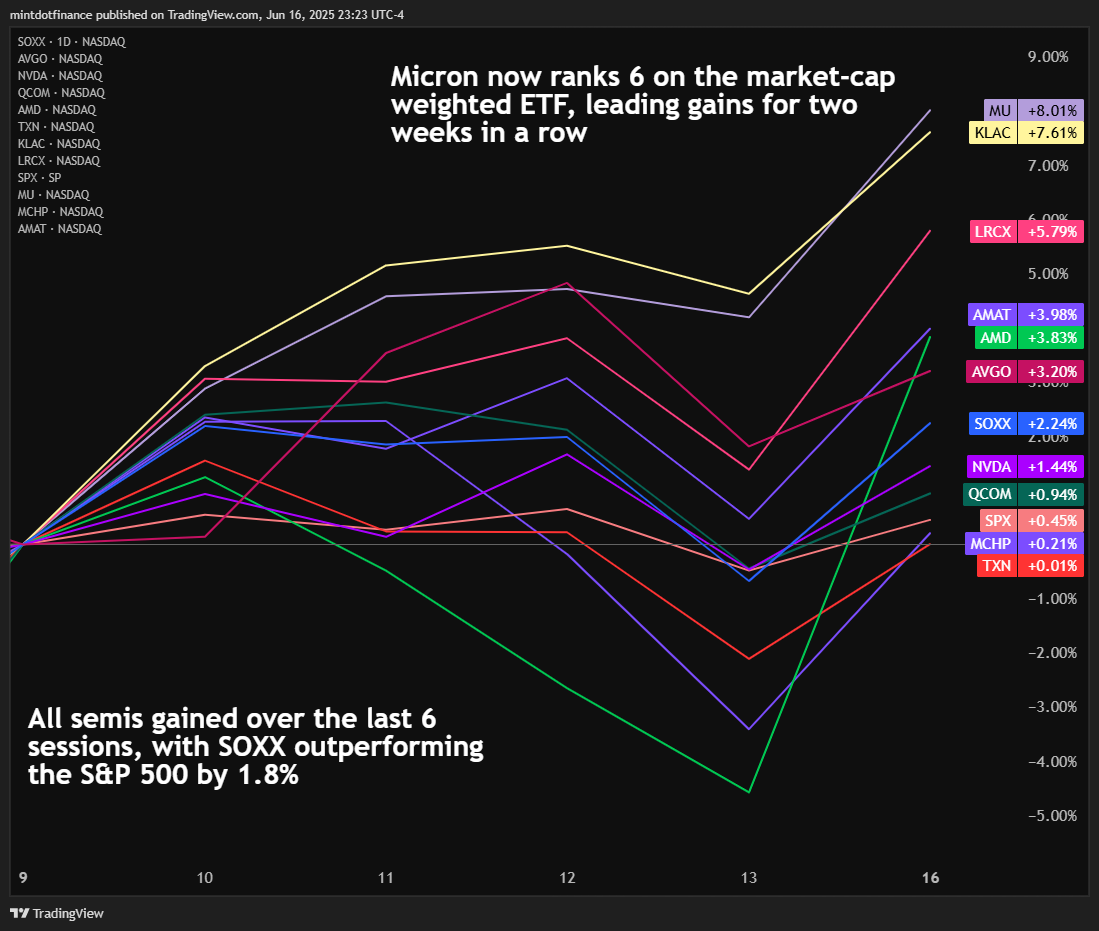

Semis climbed this week, with Micron and KLAC leading gains. While fund flows into SOXX turned positive after last week’s outflows, positioning stayed defensive, with options data pointing to cautious re-engagement rather than risk-on momentum.

This edition unpacks Taiwan’s latest export controls and what they imply for TSMC and SMIC, dissects CoreWeave’s unusual partnership loop with Google and OpenAI, and tracks what key technicals indicate about SOXX. We end with a look at where market conviction still feels thin, and where it might begin to firm up.

Stock Scoreboard

Semiconductor stocks extended their gains last week, but leadership within the SOXX top 10 continued to rotate. Micron led the charge with an 8% weekly rise, driven by new HBM4 qualification samples and momentum around its CHIPS Act–backed U.S. manufacturing expansion.

KLAC followed closely, hitting fresh 52-week highs after a six-day winning streak, underlining investor confidence in its strong financials, capital returns, and the equipment-cycle exposure.

Applied Materials returned to the top 10 this week, displacing Monolithic Power Systems. The rotation reflects a broader shift into diversified foundry suppliers and front-end logic tools, following Morgan Stanley’s upgrade earlier this month, as well as a cash dividend announcement last week.

KEY HEADLINES:

Taiwan’s Huawei-SMIC Ban Sends a Message, Not a Shockwave

Taiwan has intensified its technology export controls, placing Chinese semiconductor giants Huawei and SMIC on its strategic high-tech commodities entity list. Taiwanese companies must now seek explicit governmental approval before exporting any technology products or services to these two firms, highlighting concerns around IP security and talent poaching.

For TSMC, these tightened restrictions may appear minimally impactful at first glance, considering the foundry giant had already commenced distancing from mainland China. TSMC halted advanced-node chip production (7nm and below) for Chinese clients last year, after its own discovery revealed that Huawei’s Ascend 910B AI chip had ties to its fabrication processes.

However, the nuance lies in the broader geopolitical alignment TSMC maintains. Nvidia relies heavily on TSMC, which inherently binds the latter’s strategic considerations closely to U.S. interests. While TSMC's technological leadership gives it substantial leverage, the foundry remains vulnerable to political strongarming precisely because its customer base is highly sensitive to U.S. government regulations and policies.

The underlying subtext is that TSMC's dominance doesn't provide immunity; it instead makes the company a critical geopolitical tool, requiring constant careful navigation. Having said that, the imposition of these export controls only reinforces TSMC’s strategic shift away from potential risks associated with Chinese clients—essentially solidifying rather than changing the existing trajectory and putting a tangible dent on their business.

In contrast, the ramifications for SMIC are more interesting. Unlike Huawei, which directly relied on foreign-foundry technology for advanced chips, SMIC itself is tasked with bolstering domestic chip self-sufficiency. SMIC’s direct access to advanced Taiwanese semiconductor equipment, components, and expertise is now ‘officially’ cut off. Yet, the foundry has been ramping up investment significantly, focusing on domestic technology, talent deployment, and production capability to bypass international supply chain constraints.

The chart below depicts how, among the top five global foundries, only SMIC managed to grow in Q1 2025, also increasing its market share by over 9%:

This added control from Taiwan might complicate but won't entirely stall SMIC's trajectory. Instead, it sharpens the urgency for SMIC to localise and innovate internally, a trajectory that aligns with Beijing’s long-term vision for semiconductor independence.

Thus, rather than a crippling blow, Taiwan’s move is unlikely to impact either TSMC or SMIC to a great extent; though, for the latter, technological autonomy could be a tad bit costlier and slower at the worst.

CoreWeave’s Strategy with Google and OpenAI Masks Sustainability Questions

Under a new three-way arrangement, CoreWeave will supply compute capacity to Google Cloud, which will then resell this capacity to OpenAI. The complex, multilayered agreement mirrors a previous circular leasing deal between Microsoft, Oracle, and OpenAI, raising eyebrows due to the unusual overlap of competitive cloud giants engaging in what amounts to brokerage-style agreements.

At first glance, Google’s role might appear contradictory—supplying critical compute resources to OpenAI, a direct rival to its in-house DeepMind. However, Google’s involvement makes tactical sense. By intermediating CoreWeave's capacity, it positions itself as a key infrastructure partner; the strategic ambiguity allows Google Cloud to leverage its compute capacity, diversify revenue streams, and maintain visibility on AI projects without explicitly endorsing OpenAI.

CoreWeave’s meteoric rise, on the other hand, has also sparked scrutiny. Prices have nearly quadrupled since its IPO earlier this year, prompting Bank of America to downgrade the stock. A price target hike to $185 implies further upside, though, with analyst Brad Sills acknowledging underlying fundamentals and lower-cost debt financing.

However, the core issue flagged was sustainability. Trading at 25 times the 2027 EBIT—significantly above peer valuations of approximately 16x—raises legitimate concerns that CoreWeave’s buoyancy may partly be explained by market mechanics rather than purely fundamental factors.

The limited float and strong momentum among investors are inflating valuations. Though Google’s entry brings some diversification, it’s offset by Microsoft’s outsized role—accounting for 62% of CoreWeave’s 2024 revenue—as well as its recent pullback from data center leases and reassessment of OpenAI exposure. Put simply, one door opens as another begins to close.

Moreover, CoreWeave's recent sale of its entire stake in Applied Digital after establishing long-term leases underscores an aggressive financial engineering approach to bolster short-term market sentiment.

While Google’s positioning can be interpreted as tactically savvy and CoreWeave’s immediate trajectory appears robust, sustainability hinges significantly on how well CoreWeave transitions from opportunistic partnerships and complex financial structures toward stable and recurring revenue streams.

To differentiate between genuine strategic value and short-term market exuberance, then becomes prudent to cut through CoreWeave's compelling near-term narrative and its longer-term execution risks.

SOXX ETF:

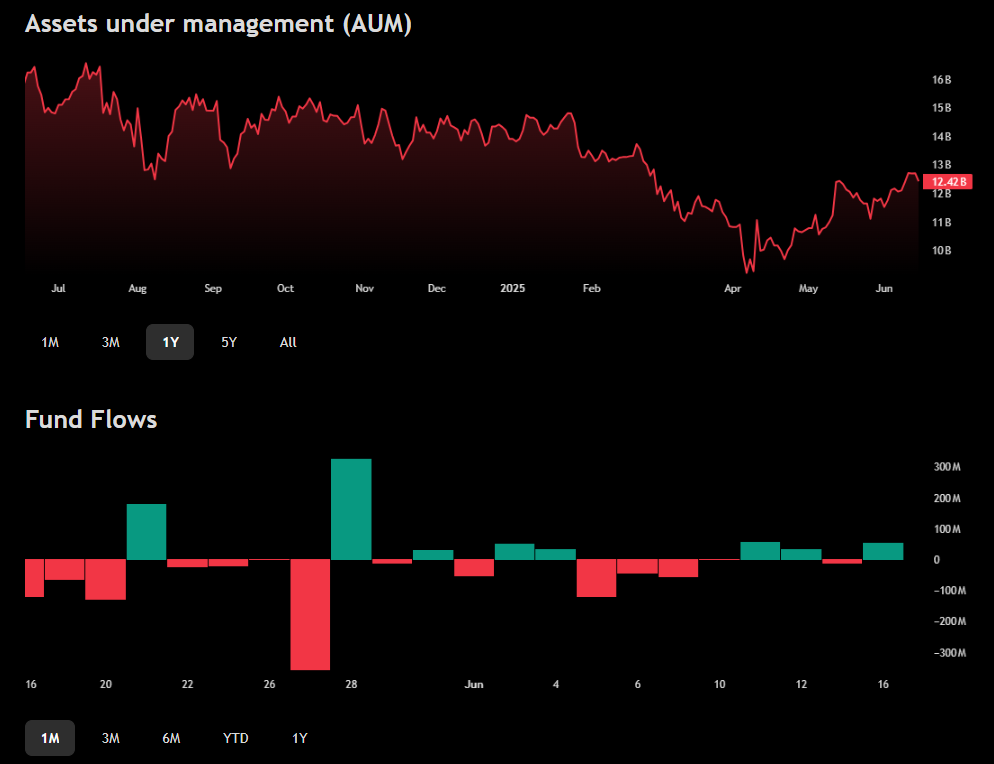

The SOXX gained 2.24% last week. Net inflows stood at $80.35, a contrast from last week’s $184 million in outflows.

The open interest for SOXX options at 166,179 contracts is up 15.6% from the 30-day average, and is also 11% higher than last week’s OI. The week-on-week increase in market activity has negatively skewed the put-call ratio towards a bearish outlook, changing from 1.03 the week before to 1.23 as of today.

SOXX closed the week up 2.24%, holding above the $220 handle and decisively testing R1. Yet, the move came with some technical restraint. RSI and MACD continued to show signs of topping out, with RSI hovering near overbought territory and MACD flattening recently despite positive price action. Volume didn’t meaningfully accelerate on the breakout, and flows into SOXX, while positive at $80 million, were less than half of what was pulled out the week before.

The most telling sign came from the options side. Open interest rose 11% week-on-week, but the PCR flipped sharply bearish. Instead of chasing a rally, traders seem to be positioning to re-engage through hedges.

Takeaway:

The market was expected to start drawing harder lines between suppliers with geopolitical clearance and those without, between companies riding structural demand and those riding proximity to hype. It has not yet done so as regards either of the two key headlines, but in our view, the second consideration still holds (or should hold) greater importance.

The export controls from Taiwan aren’t disruptive in themselves, but they reaffirm a framework where alignment with U.S. strategic priorities is now essential for the more status-quo firms. For investors, this is quietly shifting the definition of what makes a semiconductor stock investable, all while being cognisant of high disruption possibilities across geographies.

At the same time, high-growth infrastructure players could continue to face growing scrutiny if revenue streams depend too heavily on indirect exposure or financial structuring. Valuations are getting more sensitive to sustainability, and revenue quality should rightfully be pulled back into the spotlight.

Investors are likely to show a preference for firms whose models don’t require interpretation, and where scale isn’t conditional on third-party access. In that sense, simplicity is seemingly mispriced. The most compelling setups right now may not be the loudest or fastest growing, but the ones clean in customer base and capital structure, and also stable on the regulatory footprint.