[Mint Daily Wrap 19/Jun] Silver Breaks Out, Iron Ore Breaks Down

Geopolitics rattles nerves, but silver’s surge and the Fed’s tariff warnings may be pointing to deeper economic fault lines.

The Fed kept rates steady, warning tariffs could push inflation higher, complicating its rate-cut path.

Silver holds near 13-year highs, driven by tight supply and firm industrial demand, outshining other safe havens.

Crude rebounded on fresh strikes, but no supply disruption yet, leaving the rally on shaky ground.

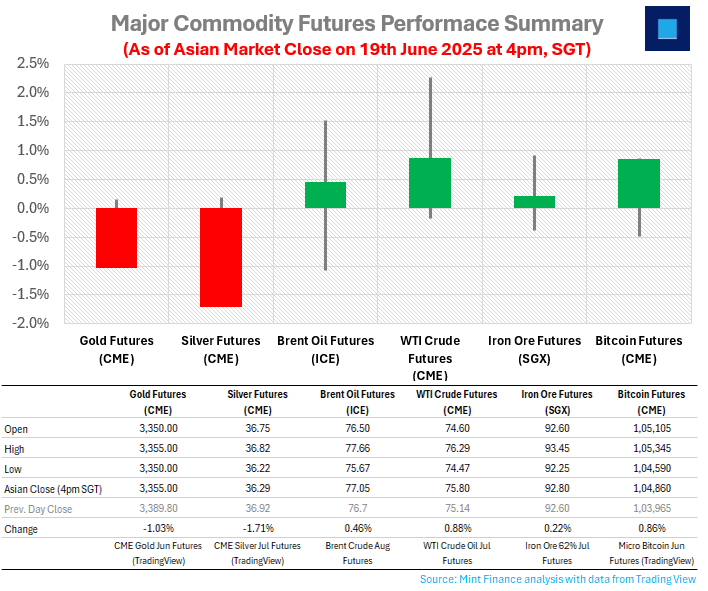

SUMMARY MARKET ACTION

Nikkei-225 Pulls Back Amid Rising Geopolitical Tensions and Cautious Fed Outlook

The Nikkei-225 slipped from its recent four-month peak, ending a three-day upward streak as escalating geopolitical concerns unsettled investors. Anxiety grew following news that the US may be gearing up for a strike against Iran, raising fears of wider turmoil in the Middle East.

The downturn also came after the US Fed opted to hold interest rates steady, emphasising a cautious approach due to inflation pressures linked to tariffs imposed by Trump.

Meanwhile, domestic investors are closely watching forthcoming inflation figures, which are expected to influence the BoJ’s future monetary policy decisions.

Gold Slips, Silver Steadies as Middle East Tensions and Fed Signals Stir Market Jitters

Gold dropped to $3,363 as the Israel-Iran conflict escalated, with Israel striking sites in Tehran and the U.S. considering involvement. The Fed held rates steady but signaled possible cuts, despite concerns about inflation and criticism from Trump.

Silver held above $36.82 as Middle East tensions and Fed caution lifted demand. Fears of a U.S. strike on Iran added to market anxiety. Strong industrial use and a fifth straight annual supply deficit continue to support prices.

Oil Prices Rebound Amid Geopolitical Uncertainty and Fed’s Dovish Signal

Crude oil prices rebounded after a weak open as reports of an Israeli strike on Iran’s Arak heavy water reactor heightened geopolitical tensions. Markets remain on edge amid uncertainty, with President Trump offering no clarity on potential U.S. military action following a meeting with top advisers.

While fears of a broader conflict persist, Tehran has not yet threatened to cut off crude flows through the Strait of Hormuz, a key chokepoint for global oil shipments.

Meanwhile, the Federal Reserve held interest rates steady but maintained its forecast for two rate cuts in 2025, offering mixed signals to markets. While this disappointed Trump, the prospect of looser monetary policy could support economic growth and, by extension, oil demand.

Iron Ore Prices Gain Slightly, But Challenges Linger

Iron ore futures showed modest gains in early Asian trading hours. Nonetheless, the ongoing turmoil in China’s real estate market continues to suppress demand prospects for iron ore. According to broker Hexun Futures, demand from downstream industries in China has slowed due to seasonal factors, while stockpiles keep building up.

Construction and industrial activities have also been hindered by unfavorable weather, with heavy rains disrupting projects in southern areas and extreme heat impacting operations in the north. Meanwhile, Goldman Sachs projects that demand for new housing in China will stay significantly below its 2017 highs for the foreseeable future, indicating a prolonged downturn in China’s property market.

MACRO WATCH

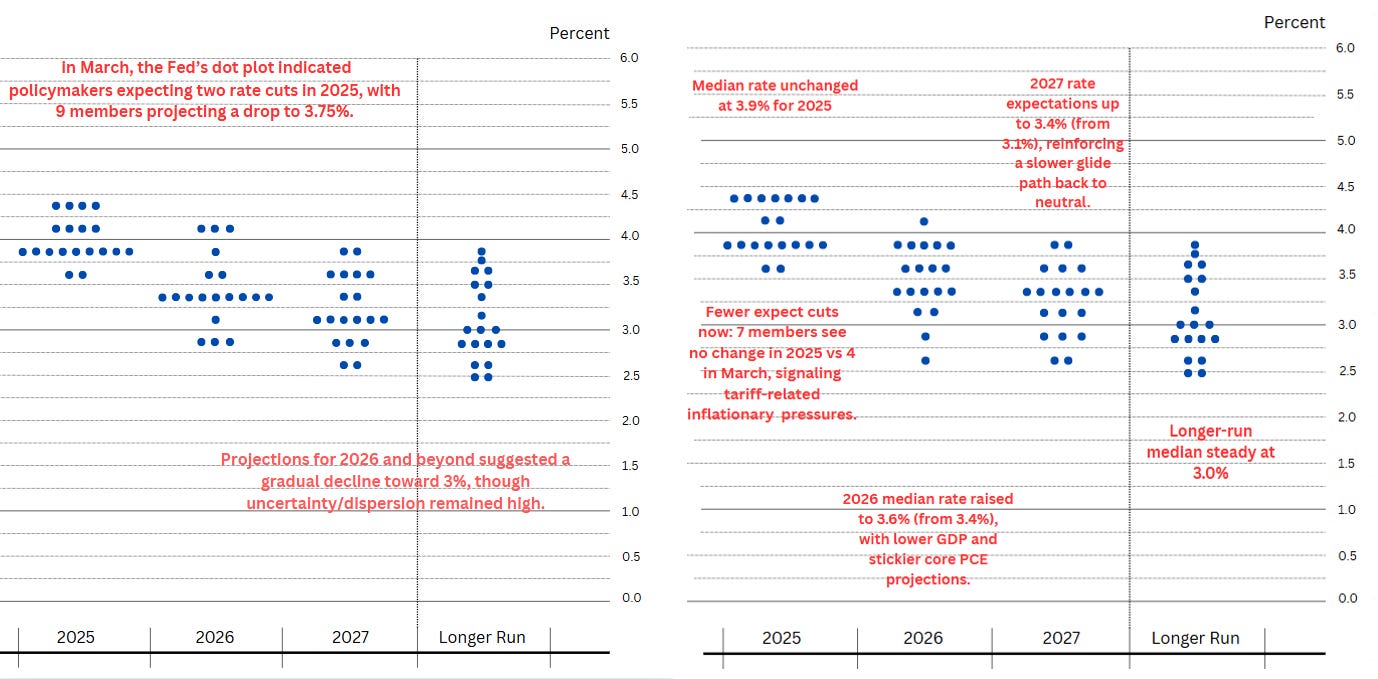

Fed Holds Rates Steady, Warns of Tariff‑Driven Inflation

The Federal Reserve maintained its benchmark rate at 4.25%–4.50% on Wednesday, signalling possible rate cuts in 2025 but cautioning that upcoming import tariffs may pressure inflation.

Chair Powell emphasised that while recent inflation readings have remained subdued, the “meaningful” cost impacts of tariffs will become clearer in the months ahead. He noted that it would be the end consumer who would face the true burden of the tariffs.

Fed projections showed slowed growth, higher unemployment, and inflation ending in 2025 around 3%. Despite some policymakers expecting no cuts, uncertainty remains high, especially amid global trade tensions and Middle East unrest.

THIS DAY IN HISTORY

REVEALING THE ANSWER FOR PREVIOUS GUESS THE CHART

WHAT’S CAPTIVATING US

Everyone’s watching oil, but silver is the chart that won’t sit still.

It keeps hitting 13-year highs quietly, without the headlines gold or Bitcoin get, and that tells you something. This isn’t a typical flight-to-safety move but more like a structural squeeze.

On one end, Chinese industrial demand is still pulling silver through the system, even as other commodities tied to its old economy (iron ore) keep sliding. On the other hand, Latin American supply issues haven’t gone away, and miners aren’t catching up.

Put that together, and silver is trading like a constrained input in a world that’s still trying to electrify. Traders may be too focused on Fed speak or crude tail risks right now, but silver’s strength, much like iron ore’s decline, is hinting at tensions as regards industrial tightness in a slowing macro.