[Mint Daily Wrap 07/Jul] Markets in Flux: Trade Turmoil, Corporate Bitcoin Rush, and Commodity Pressures

Geopolitical risks, shifting institutional flows, and supply-demand imbalances drove a volatile start to the day, with markets from equities to crypto adjusting to rising uncertainty.

U.S. tariff announcements and BRICS-related duties reignited uncertainty, pressuring equity markets globally and stalling fresh investor positioning.

Corporate Bitcoin purchases surged in Q2 2025, outpacing ETFs for the third straight quarter, as firms adopt BTC as a strategic reserve asset.

OPEC+'s surprise output hike weighed on oil prices, while iron ore prices retreated due to Chinese curbs and new trade barriers, raising concerns about demand.

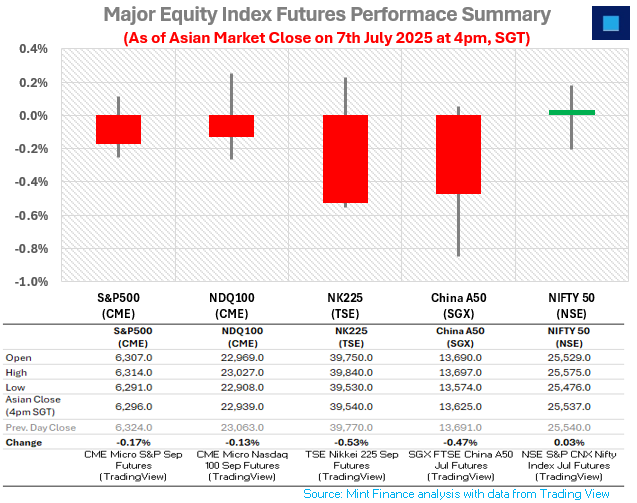

SUMMARY MARKET ACTION

Nikkei Slips as Markets Weigh Tariff Timelines and Trade Talks

Japan’s Nikkei share average extended its downward streak on Monday, dragged lower by renewed concerns over upcoming U.S. trade measures. The market reacted cautiously after Trump reaffirmed that wide-ranging reciprocal tariffs would be implemented starting August 1.

Treasury Secretary Scott Bessent indicated that countries without finalized trade agreements would see tariffs revert to levels set on April 2, effectively offering a window for extended negotiations.

Investors responded to a minor drop in the Nikkei with increased selling. Shoichi Arisawa at IwaiCosmo Securities observed that market participants were hesitant to take fresh positions amid a lack of clarity around the U.S. tariff framework.

U.S. Stock Futures Retreat as Trump Flags New BRICS Tariff Plan

U.S. equity futures fell Monday after President Trump announced a new 10% tariff targeting countries aligned with what he described as “Anti‑American policies of BRICS.”

Treasury Secretary Scott Bessent added that if no progress is made by August 1, tariffs will return to early April levels. Markets had been buoyed last week by a rebound to all-time highs on hopes of avoiding the most draconian trade measures.

Despite ongoing uncertainty over trade negotiations, some analysts argue that companies may beat low earnings expectations by navigating new tariff structures effectively.

Gold Dips, Silver Steadies: Markets Balance Trade Hopes Against Rate Cut Uncertainty

Gold slipped to $3,305.5 as trade deal hopes rose and rate cut bets eased after strong U.S. jobs data. Tariff threats and fiscal policy updates kept investors cautious.

Silver futures hover near $37, weighed by a strong dollar and delayed rate cut hopes, but solid industrial demand supports a potential breakout.

Bitcoin's Power Shift: From Whale Dumps to Institutional Stability and Slower Gains

Bitcoin is nearing a market peak, but shifting from whale-led trades to institutional holders may stabilize it for years. Experts see it evolving into a slower-growing, 10–20% return asset.

WTI Slips as OPEC+ Boosts Output and Demand Fears Mount

WTI crude fell on Monday, extending last week’s slide as OPEC+ announced a steeper-than-expected production hike. The group will increase output by 548,000 bpd in August, well above the anticipated 411,000 bpd, citing a stable global economy and low inventories. This unexpected move raised oversupply concerns, weighing on market sentiment.

Adding to the pressure, investors are assessing the impact of upcoming U.S. tariffs, set to take effect on August 01. While final rates remain under negotiation, both President Trump and Commerce Secretary Lutnick confirmed their return. Meanwhile, signs of weakening demand, evident in soft Chinese services PMI data fuelled a more bearish outlook.

Iron Ore Futures Retreat as Tangshan Curbs and Trade Risks Reignite Demand Worries

Iron ore futures edged lower on Monday as the market turned cautious amid renewed concerns around demand sustainability. The decline followed fresh production curbs in Tangshan, China’s key steelmaking region, where authorities have mandated output restrictions for environmental reasons. Several local steel mills have reportedly begun maintenance on sintering operations, further weakening short-term iron ore consumption.

Adding to the pressure, Malaysia announced provisional anti-dumping tariffs ranging from 3.86% to 57.90% on select Chinese iron and steel products, effective for up to 120 days. This move fuels broader trade uncertainty at a time when global markets are already contending with ongoing tariff-related risks from the United States.

MACRO WATCH

THIS DAY IN HISTORY

REVEALING THE ANSWER FOR PREVIOUS GUESS THE CHART

TODAY’S GUESS THE CHART

What’s a daily market wrap without something to intrigue the reader leading to head-scratching moments?

Guess this chart and send in your answer to research@mintfinance.xyz, or attempt the poll below. We will reveal the answer in the next issue.

WHAT’S CAPTIVATING US

Public companies are rapidly increasing their exposure to Bitcoin, signaling growing institutional confidence in the asset. In Q2 2025 alone, they purchased 131,355 BTC—an 18% increase in holdings, according to Bitcoin Treasuries data. ETFs, by comparison, acquired 111,411 BTC, marking an 8% rise. Notably, this was the third consecutive quarter where corporate purchases outpaced ETF inflows.

Year-to-date, public companies have accumulated 237,664 Bitcoins, more than double the 117,295 bought by ETFs. Their combined holdings now stand at approximately 855,000 BTC, representing around 4% of Bitcoin’s total supply.

This trend underscores a shift in corporate treasury strategies, with firms increasingly viewing Bitcoin not just as a speculative asset, but as a long-term store of value and hedge against macroeconomic uncertainty. As institutional adoption deepens, public companies are emerging as a key force shaping Bitcoin’s supply dynamics and price trajectory.

Source: Coinweb