[Mint Daily Wrap 08/Jul] Tariffs, Tensions & Trade Routes: A Global Market Crossroad

As U.S. tariffs ripple through global markets, investors navigate policy uncertainty, shifting trade flows, and evolving geopolitical risks.

Markets remained volatile as U.S. tariff extensions and trade rerouting concerns collided with earnings optimism and shifting commodity trends.

Geopolitical maneuvering reshaped trade routes, as U.S. policy actions triggered ripple effects across Asia and commodity supply chains.

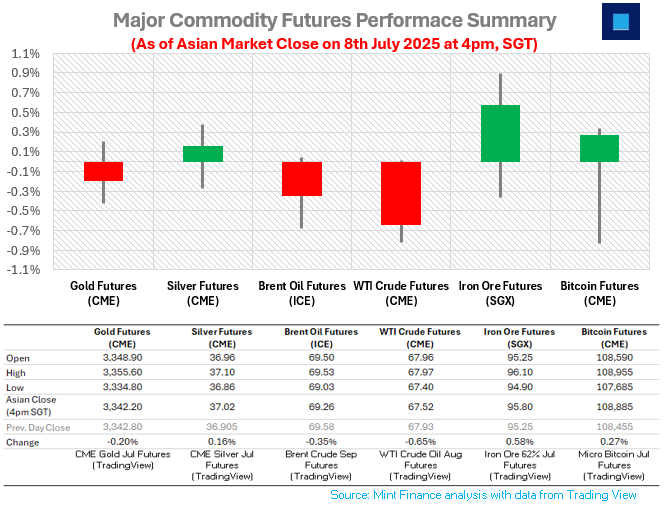

Asset-specific dynamics revealed diverging paths: gold cooled, Bitcoin held firm, crude slipped on OPEC+ hikes, while iron ore edged higher on solid China demand.

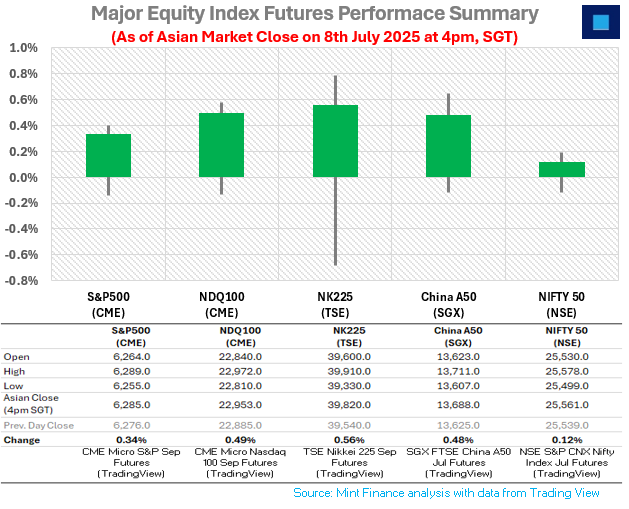

SUMMARY MARKET ACTION

Nikkei Rallies as Yen Slips and Trade Hopes Flicker

Japan’s Nikkei surged on Tuesday, driven by a softer yen and hopes of a trade resolution. Market optimism followed Trump's decision to grant a three-week extension for tariff discussions, temporarily easing pressure ahead of a proposed 25% import levy on Japanese goods set for August 1.

While the door to dialogue remains open, Trump warned of equal retaliation against any countermeasures. In response, Japanese Prime Minister Shigeru Ishiba affirmed his commitment to pursuing constructive talks with Washington to secure a mutually advantageous deal.

Stock Futures Steady as Trump Expands Tariff Targets and Delays Deadline

U.S. stock futures held mostly flat Tuesday after President Trump extended the deadline for new “reciprocal” tariffs to August 1 and expanded the list of targeted countries to 14.

The prior session saw broad market declines as investors reacted to trade policy developments, but many remain optimistic that earnings season will sustain the S&P 500's momentum near record highs.

Gold Slips, Silver Steady Ahead of Fed Minutes

Gold dipped to $3,334 as trade tensions eased and strong U.S. jobs data lowered Fed rate cut hopes. Markets now eye Wednesday’s Fed minutes.

Silver Futures for July 2025 have been trading in a tight range around $37, just slightly off recent highs

Bitcoin Holds Above $107K, Eyes Breakout Toward $120K

Bitcoin is holding firm above $107K with bullish futures signals, strong support, and macro tailwinds, potentially setting the stage for a breakout to $120K.

Oil Slips on OPEC+ Supply Hike and U.S. Tariff Risks, Red Sea Tensions Limit Losses

WTI crude oil futures fell on Tuesday, pulling back from a two-week high as markets weighed the impact of rising OPEC+ supply and escalating U.S. trade tensions.

President Trump announced steep tariff hikes on several trade partners starting August 1, though he left room for flexibility. This raises concerns about potential drag on global growth and oil demand. Still, signs of firm U.S. demand have helped cushion the downside.

Meanwhile, OPEC+’s fourth consecutive monthly hike exceeded market expectations. This added to bearish sentiment, though losses were limited by renewed geopolitical tensions after Yemen’s Houthi rebels launched another attack on ships in the Red Sea, threatening vital global shipping routes.

Resilient China Demand and Inventory Dip Bolster Iron Ore Recovery

Iron ore futures edged higher on Tuesday, lifted by sustained near-term demand from China and signs of easing global trade tensions. Market sentiment improved as Trump showed a willingness to resume tariff talks after issuing initial warnings to trade partners.

Chinese demand remained solid, with hot metal output holding steady at 2.41 million tons as of July 3, up 0.6% YoY, according to Mysteel. Further supporting prices was a 0.4% WoW drop in portside inventories, which fell to 144.04 million tons by July 7.

Zhuo Guiqiu, analyst at broker Jinrui Futures, noted that while the recent surge driven by anti-price war measures has faded, the downside for prices may be limited due to the balanced supply-demand backdrop.

THIS DAY IN HISTORY

REVEALING THE ANSWER FOR PREVIOUS GUESS THE CHART

TODAY’S GUESS THE CHART

What’s a daily market wrap without something to intrigue the reader leading to head-scratching moments?

Guess this chart and send in your answer to research@mintfinance.xyz, or attempt the poll below. We will reveal the answer in the next issue.

WHAT’S CAPTIVATING US

China's direct exports to the U.S. dropped sharply by 43% year-over-year in May, amounting to a $15 billion decline. At first glance, this may seem like a clear sign that U.S. tariffs are working. But a closer look tells a more complex story.

Despite the plunge in shipments to the U.S., China’s overall exports rose by 4.8% in the same month, according to official data. Where did all that trade go? Primarily to nearby economies. Exports to ASEAN countries jumped 15%, and shipments to the European Union climbed 12%. Notably, re-exports through Vietnam surged 30% to $3.4 billion, while trade routed through Indonesia grew 25%.

This pattern suggests Chinese firms may be rerouting goods through third countries to bypass U.S. tariffs, a form of "transshipment." In response, Washington recently struck a deal with Vietnam imposing a 40% tariff on such redirected goods. The move signals a new phase in U.S.-China tension, a proxy trade war fought through regional partners.

Source: WorldCargo News