[Mint Daily Wrap 09/Jul] Tariff Heat and Fed Uncertainty Stir Mixed Signals Across Global Assets

Global markets navigated yen-led equity gains, tariff fears, and inflation signals, triggering cautious risk-taking before key policy cues.

Nikkei climbed on yen weakness, but profit-taking near 40,000 and looming U.S. tariffs capped gains despite resilient broader market sentiment and sector rotation.

Gold and silver declined as a stronger dollar, rising yields, and renewed Trump tariff threats pressured metals; all eyes now turn to Fed minutes.

Iron ore prices climbed as supply from Australia and Brazil tightened, while China’s inflation data highlighted a fragile yet stimulus-driven economic recovery.

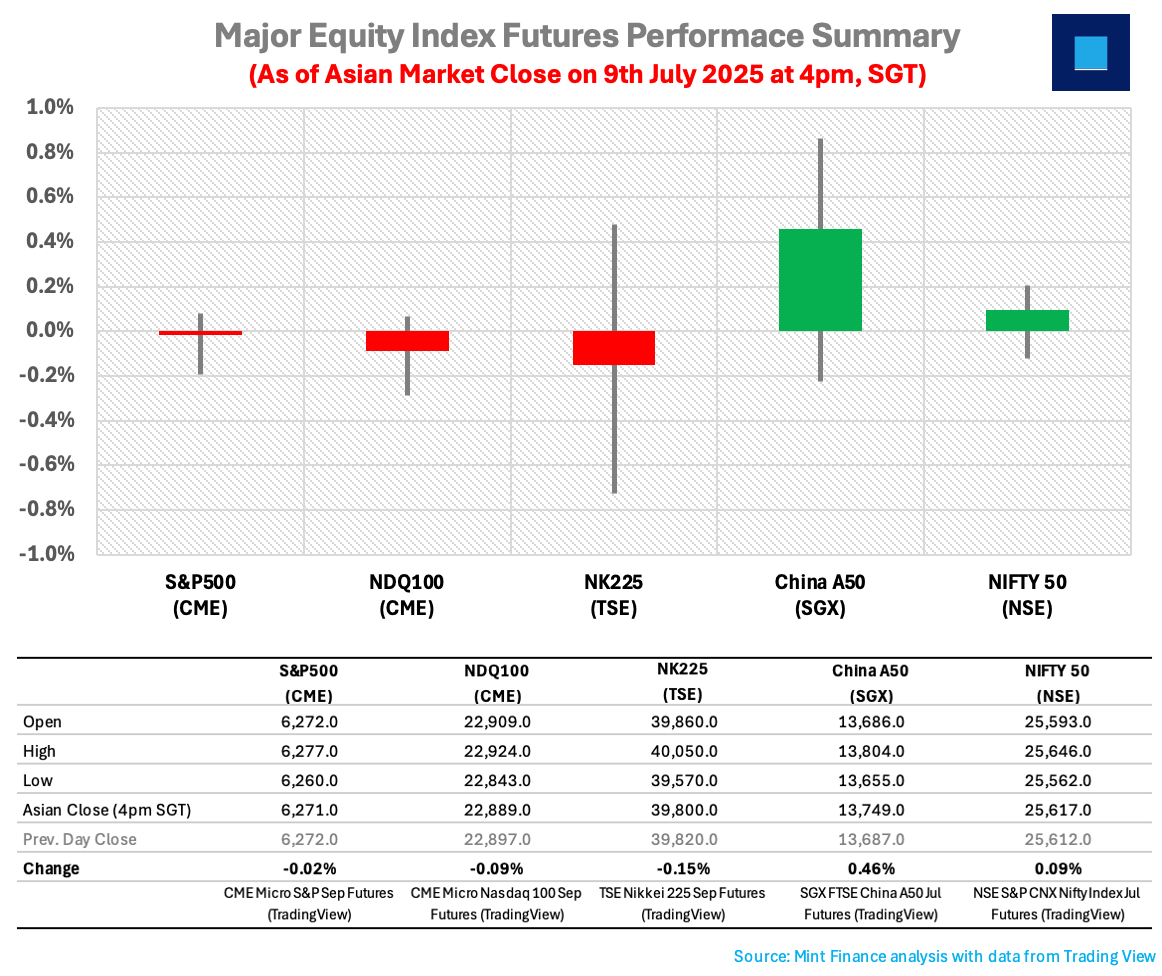

SUMMARY MARKET ACTION

Nikkei Edges Higher on Yen Slide, but Tariff Tensions and Profit-Taking Temper Gains

Japan’s Nikkei index ended higher on Wednesday, buoyed by a softer yen that boosted exporter sentiment. However, the rally lost steam as investors locked in gains near the 40,000 mark.

Market participants also weighed the U.S. decision to proceed with 25% tariffs starting August 1. While Prime Minister Shigeru Ishiba expressed disappointment, he reiterated Tokyo’s intent to keep engaging with Washington for a constructive outcome.

Shuutarou Yasuda, a market analyst at Tokai Tokyo Intelligence Laboratory, noted that broader sentiment remained resilient, with the Topix advancing as traders rotated positions across sectors.

Gold and Silver Slide as Dollar Strengthens and Tariff Fears Rise

Gold fell to $3,287/oz as a stronger U.S. dollar, rising Treasury yields, and fresh tariff threats from President Trump weighed on sentiment. Silver followed suit, slipping 0.4% to $36.62/oz, mirroring gold’s weakness amid broader macroeconomic pressure. Investors now await the Fed minutes for clues on future rate moves.

Bitcoin Futures Steady Amid Volatility, Traders Watch Fed and Inflation Signals

Bitcoin futures showed muted movement but remained volatile, with traders eyeing inflation data and Fed minutes for direction. Both assets face short-term pressure from macro uncertainty.

Iron Ore Gains on Supply Squeeze as China Inflation Paints Mixed Economic Picture

Iron ore futures extended their upward momentum in early Asian trading on Wednesday, lifted by signs of tightening supply and steady end-user demand.

Export volumes from key suppliers Australia and Brazil continued to shrink, stoking fresh concerns over constrained availability of the steel-making ingredient in top buyer China.

Meanwhile, China's macroeconomic backdrop offered contrasting signals. Consumer prices inched up 0.1% YoY in June 2025, the first positive print since January. This uptick was fueled by robust online shopping campaigns and targeted government stimulus.

On the flip side, producer prices tumbled 3.6% YoY, sharper than the estimated 3.2% decline. This decline underscored persistent industrial weakness, hampered by fragile domestic activity and growing uncertainties surrounding U.S. trade policy.

MACRO WATCH

U.S. Firms Caught in Growth‑Inflation Tug‑of‑War

Recent surveys of U.S. CFOs and global business leaders reveal a tense dilemma: whether slowing economic momentum or rising inflation poses the greater risk to the economy.

Many firms expect to raise prices, often beyond projected revenue growth, even those not directly exposed to tariffs, signalling that inflation is becoming more broad-based. Meanwhile, global executives are delaying capital spending amid weak demand. This divergence complicates the Federal Reserve’s decisions, increasing the likelihood that it will postpone interest-rate cuts until September or later.

THIS DAY IN HISTORY

REVEALING THE ANSWER FOR PREVIOUS GUESS THE CHART

TODAY’S GUESS THE CHART

What’s a daily market wrap without something to intrigue the reader leading to head scratching moments?

Guess this chart and send in your answer to research@mintfinance.xyz, or attempt the poll below. We will reveal the answer in the next issue.

WHAT’S CAPTIVATING US

Copper markets erupted as Trump intends to implement a sweeping 50% tariff on all copper imports, his fourth broad-based tariff in his second term. While the timeline remains unclear, copper futures spiked 15% to a record $5.68 per pound.

Copper prices have jumped 38% this year, fuelled by accelerated stockpiling as businesses move to secure supply before Trump’s planned tariffs significantly increase import costs. The US imported $17 billion in copper last year, with Chile alone supplying over a third, raising fears of cost surges for U.S. manufacturers reliant on the red metal.

Meanwhile, Trump also signaled a looming 200% tariff on pharmaceutical imports, aiming to bolster domestic production under national security grounds. Australia, a key pharma exporter, called the proposal “very concerning”.

The uncertainty around tariff implementation timing, compounded by ongoing “reciprocal” rate negotiations, is keeping markets on edge. For now, Trump’s trade playbook is back in focus: with copper and pharma in the crosshairs.