[Mint Daily Wrap 20/Jun] Markets Caught Between Geopolitics and Japan’s Inflation Curve

With oil trading on headlines and Japan flirting with structural inflation, markets are starting to price in risks that go beyond the usual suspects.

WTI logs third weekly gain as Middle East tensions escalate, but Iran keeps exports flowing.

Japan’s core inflation hits 3.7%, reviving BoJ rate hike risks amid fragile growth.

Silver breaks support, Bitcoin supply tightens, and Ethereum sees record inflows.

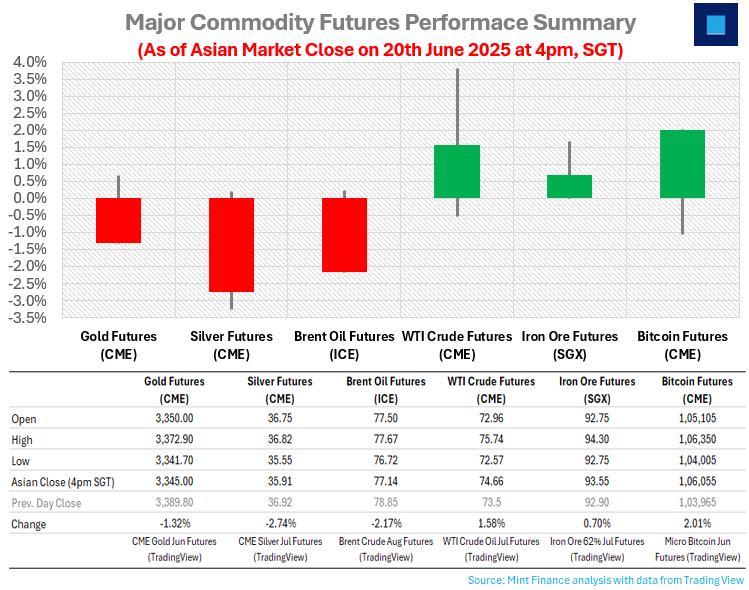

SUMMARY MARKET ACTION

Geopolitical Tensions and Inflation Risks Weigh on Japanese Equities

Japanese equities slipped on Friday amid intensifying geopolitical tensions. Overnight, Israel targeted Iranian nuclear facilities, prompting retaliatory drone and missile strikes from Tehran, deepening a week-long aerial conflict that shows no sign of resolution.

Meanwhile, the BoJ highlighted that gradual interest rate increases, driven by rising input costs, could heighten the risk of a wage-price spiral. Although Japan’s transmission of higher raw material prices to end consumers has been less intense than in Europe, lingering second-round inflation effects continue to pose challenges.

Gold and Silver Slide Amid Geopolitical Tensions and Bearish Signals

Gold fell below $3,360, heading for its first weekly loss in three weeks as investors sold amid Middle East tensions. Rising tensions, with the U.S. potentially entering the conflict, and sticky inflation, all weighed on sentiment despite Fed rate cut signals.

Silver slipped below $35.90, breaking a key support level as it continues to trade under bearish pressure. The price remains below its 50-day EMA, reinforcing a downward trend. While RSI shows oversold conditions, which may slow further losses, the overall outlook stays negative in the short term.

Bitcoin Supply Tightens, Ethereum Inflows Soar

Bitcoin is trading around $104,970, supported by strong long-term holding trends. Ancient supply—BTC held for over 10 years—is now growing faster than new issuance, boosting scarcity. With 88.88% of holders in profit and fewer coins entering circulation, long-term bullish sentiment remains strong despite short-term volatility.

Ethereum is showing breakout potential with record $34.8B open interest and $500M in inflows. Price stays above key EMAs, but needs to clear $2,600 to gain momentum.

WTI Rises on Escalating Middle East Tensions as Iran Maintains Crude Flows

WTI crude oil futures traded higher on Friday, poised for a third straight weekly gain; tensions in the Middle East have now stoked fears of potential supply disruptions.

Hostilities between Israel and Iran have intensified, with Israel launching renewed strikes on key strategic and government sites in Tehran following reports of an Iranian missile hitting a major hospital in Israel. The situation remains fluid, with diplomatic channels largely frozen.

Despite the growing tensions, Iran has managed to sustain crude exports, loading 2.2 million barrels per day so far this week, the highest volume in over a month.

Iron Ore Prices Nudge Up Amid Resilient Demand

Iron ore futures ticked upward on Friday, supported by a modest increase in blast furnace activity across China. For the week ending June 20, the blast furnace operating rate climbed to 83.82%, reflecting a 0.4% rise from the prior week, according to figures from consultancy Mysteel.

Additionally, hot metal production rose slightly by 0.24% from the previous week, reaching 2.422 million tonnes.

MACRO WATCH

Japan’s Core Inflation Hits 3.7%, Rekindling Pressure on BOJ Rate Hikes

Japan’s core CPI rose 3.7% in May, its fastest pace in over two years, driven by surging food prices like rice and chocolate. The core-core index, which strips out both fresh food and fuel, climbed 3.3%, signalling demand-driven inflation.

While services inflation also accelerated, the BoJ faces a dilemma: rising domestic prices versus economic fragility amid U.S. tariff uncertainty. Though rate hikes remain on the table for 2025, policy divisions and slower projected growth could delay action.

THIS DAY IN HISTORY

GUESS THE CHART

What’s a daily market wrap without something to intrigue the reader, leading to head-scratching moments?

Guess this chart and send in your answer to research@mintfinance.xyz, or attempt the poll above. We will reveal the answer in the next issue.

WHAT’S CAPTIVATING US

Japan may be quietly entering its most consequential macro inflection in years.

The Middle East risk premium is real: crude’s up three weeks straight, even with Iran keeping exports steady. But zooming out, Japan’s economic tightrope walk is just as revealing. Inflation is finally showing signs of becoming demand-led. Core-core CPI hitting 3.3% suggests that price pressures aren’t just imported anymore. That’s a red flag for the BoJ, especially as wage expectations rise and policymakers warn about a wage-price spiral.

For months, traders have ignored talk of rate hikes, and bets against Japanese stocks or in favour of the yen haven’t worked. But now that inflation is sticking around, that might change. If the BoJ signals it’s ready to act, currency markets will likely move before equities do. The yen could strengthen quickly, and this time, the Nikkei might take an actual hit.

The Middle East can spark short-term volatility, but Japan’s inflation handoff could give us a secular macro shift in Asia’s most deflation-scarred economy.