[Mint Daily Wrap] Markets Hold Ground; China's Oil Risk and Fed Patience Keep Nerves Tight

From Middle East flashpoints to muted CPI optimism, traders are weighing external threats and internal slowdowns.

Gold approaches record highs while Bitcoin steadies, as safe-haven flows meet crypto’s continued institutional momentum.

Japan’s equities rally on BoJ dovishness and yen weakness, while iron ore nudges higher despite steel sector contraction and falling property prices in China.

China’s reliance on Iranian oil emerges as a key tail risk amidst the simmering Middle East tensions.

SUMMARY MARKET ACTION

Japanese Equities Advanced on BoJ Policy Hopes and Yen Weakness

Japanese equities climbed on Monday as investors anticipated the BoJ would maintain its 0.5% interest rate while hinting at future tightening. Additionally, market participants largely looked past intensifying geopolitical tensions in the Middle East, where continued Israel-Iran confrontations over the weekend targeted key energy assets.

Meanwhile, a softer yen supported sentiment by brightening earnings prospects for Japan’s export-driven sectors.

Gold Nears Record High Amid Israel-Iran Tensions and Fed Cut Hopes

Gold nears record high amid escalating Israel-Iran conflict, rising as much as 0.6% to around $3,442/oz in Asia. The surge reflects heightened haven demand, weak US economic data, and expectations of Fed rate cuts. Gold is up over 30% in 2025, also supported by central banks diversifying away from the dollar.

Bitcoin Holds Strong, Altcoins Rally on Renewed Investor Confidence

Bitcoin is trading higher, showing recovery from recent geopolitical-driven volatility. Investor sentiment remains strong, supported by ETF inflows, whale accumulation, and renewed interest from major institutions.

Analysts highlight that key support levels are holding firm, with potential for further upside if the current momentum continues. The market remains calm, awaiting regulatory developments to guide the next move. Ethereum also showed strength, rebounding from recent lows amid continued whale accumulation. Likewise, Solana, Hyperliquid, and Cardano posted solid gains, reflecting renewed risk appetite across the crypto market.

Muted Market Reaction Masks Rising Oil Supply Risks for China

Despite heightened tensions between Iran and Israel over the weekend, markets opened the week with a muted reaction. Crude futures rose initially but quickly pared gains, as investors weighed the potential for supply disruptions against concerns about slow global growth.

While higher prices may prompt more U.S. shale output, the risk of disruptions in the Strait of Hormuz keeps the upside risk in focus.

China faces the greatest exposure to any disruption in Iranian oil exports; Iran produces around 3.3 million b/d, and most of its 1.5 million b/d exports flow to China’s independent refiners. A halt in these supplies could dent Chinese refinery runs, prompt state refiners to hoard fuel, and reduce crude purchases as prices climb.

Iron Ore Ticks Up Despite Weak Steel Output and Persistent Property Market Woes in China

Iron ore prices edged slightly higher in early Asian trade on Monday, even as China's steel sector showed signs of continued contraction. Crude steel production in May dropped 6.9% YoY; the production drop caught analysts off guard but aligns with Beijing’s broader goal to control oversupply.

Reinforcing expectations of a subdued outlook, the China Iron and Steel Association predicted a 4% annual decline in steel output for 2025. Meanwhile, China’s property market remained under pressure, with home prices falling 3.5% YoY, highlighting lingering weakness in one of the country’s core demand drivers for steel.

MACRO WATCH

China’s Retail Resilience Meets Industrial Headwinds

Retail sales in China rose by 6.4% YoY in May 2025, up from 5.1% in April and exceeding the anticipated 5% increase. This marked the fastest growth since December 2023, driven by holiday spending and policy support to counter U.S. tariff impacts.

Meanwhile, industrial output grew 5.8% YoY in May 2025, down from 6.1% in April and below the expected 5.9%, marking the weakest expansion since November 2024. The slowdown reflects reduced overseas demand and domestic production challenges amid ongoing U.S. tariff pressures.

THIS DAY IN HISTORY

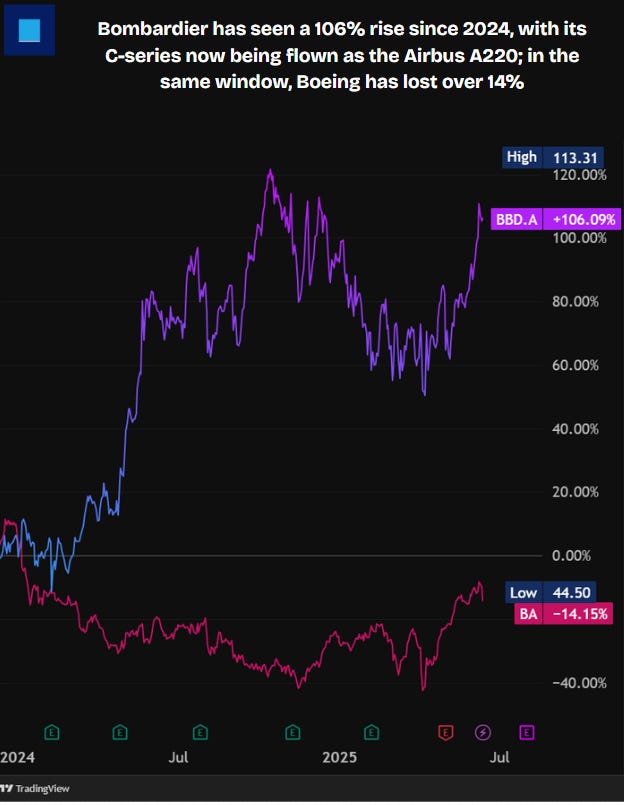

REVEALING THE ANSWER FOR PREVIOUS GUESS THE CHART

TODAY’S GUESS THE CHART

What’s a daily market wrap without something to intrigue the reader, leading to head-scratching moments?

Guess this chart and send in your answer to research@mintfinance.xyz, or attempt the poll above. We will reveal the answer in the next issue.

WHAT’S CAPTIVATING US

The oil market might be underestimating how much China has to lose.

Everyone’s watching for either a major retaliation from Iran or a disruption in the Strait of Hormuz. But there’s a more immediate risk flying under the radar: China’s heavy reliance on Iranian oil. Iran ships nearly all of its ~1.5 M bpd crude exports to China, where independent refineries have faced tight margins, quota caps, and sluggish demand, though some saw margin recovery in May.

If those shipments slow down—whether because of sanctions pressure or Iran pulling back—China’s refining system could seize up quickly. That would mean less oil processed and exported, and fewer purchases going forward. A present yet potentially distant conflict could suddenly hit demand and freight in China, affecting prices globally.

This risk, if not unfounded, hasn’t been priced in yet. Ship-tracking data for even a small drop in Iran-to-China flows this week could be an indicator for the market to rethink just how “contained” this conflict really is.